The Invisible Threat

In our increasingly digital world, identity theft has become a pervasive threat that affects millions of people each year. The consequences of identity theft can be devastating, leading to financial loss, damage to credit scores, and emotional distress. Understanding what identity theft is and how to prevent it is crucial in safeguarding your personal information and maintaining your financial well-being.

What is Identity Theft?

Identity theft occurs when someone illegally obtains and uses your personal information, such as your social security number, credit card details, or bank account information, without your permission. This can lead to fraudulent activities such as opening new accounts, making unauthorized purchases, or even committing crimes in your name.

Common Methods of Identity Theft

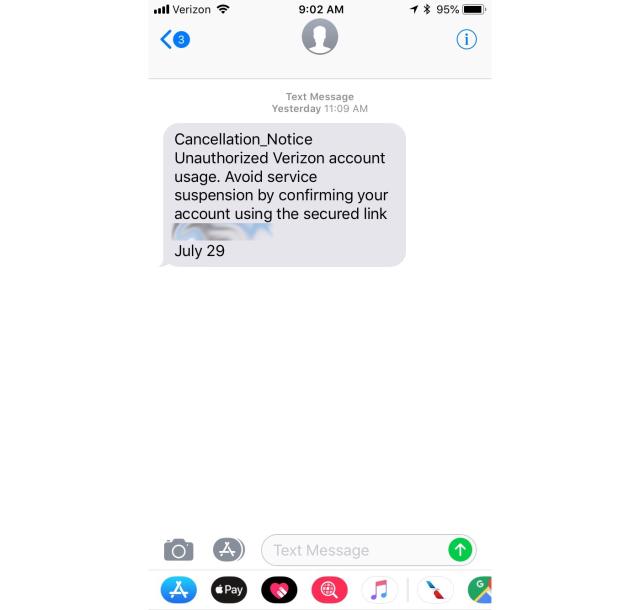

- Phishing Scams: Cybercriminals often use phishing emails or messages to trick individuals into providing personal information. These emails may appear to be from legitimate sources, such as banks or government agencies, but they contain malicious links or attachments.

- Data Breaches: Large-scale data breaches at companies and organizations can expose sensitive information of millions of individuals. Hackers can exploit security vulnerabilities to steal data, which is then sold on the dark web.

- Skimming: Identity thieves use skimming devices to capture credit card information from ATMs, gas station pumps, or point-of-sale terminals. These devices are often difficult to detect, making it easy for thieves to steal your information without your knowledge.

- Mail Theft: Physical mail can also be a target for identity thieves. They may steal mail containing sensitive information, such as credit card statements, tax documents, or pre-approved credit offers, to gain access to your personal information.

How to Protect Yourself from Identity Theft

While identity theft can be a daunting threat, there are several proactive steps you can take to protect yourself:

- Secure Your Personal Information: Be cautious about sharing personal information online and ensure that your social media profiles are set to private. Shred documents containing sensitive information before disposing of them.

- Use Strong Passwords: Create complex passwords for your online accounts and avoid using the same password across multiple sites. Consider using a password manager to keep track of your passwords.

- Enable Two-Factor Authentication: Add an extra layer of security to your online accounts by enabling two-factor authentication (2FA). This requires you to enter a code sent to your phone or email in addition to your password.

- Monitor Your Financial Accounts: Regularly review your bank and credit card statements for any suspicious activities. Set up transaction alerts to receive notifications of any unauthorized transactions.

- Be Wary of Phishing Scams: Be skeptical of emails or messages asking for personal information. Look for signs of phishing, such as misspellings, generic greetings, or unexpected attachments, and avoid clicking on suspicious links.

- Protect Your Devices: Install and update antivirus software on your devices to protect against malware. Keep your operating system and applications up to date with the latest security patches.

- Freeze Your Credit: Consider freezing your credit to prevent unauthorized access to your credit reports. This makes it more difficult for identity thieves to open new accounts in your name.

What to Do If You Become a Victim

If you suspect that you have become a victim of identity theft, take immediate action to minimize the damage:

- Report the Theft: Contact the Federal Trade Commission (FTC) and file a report at IdentityTheft.gov. Notify your banks, credit card companies, and any other affected institutions.

- Place a Fraud Alert: Place a fraud alert on your credit reports with the major credit bureaus (Equifax, Experian, and TransUnion). This alerts creditors to take extra precautions when verifying your identity.

- Close Compromised Accounts: Close any accounts that have been tampered with or opened fraudulently. Notify the companies where the accounts were opened and provide them with a copy of your FTC report.

- Monitor Your Credit: Regularly check your credit reports for any new or suspicious activities. You can request free credit reports annually from each of the major credit bureaus.

To Wrap Up

Identity theft is a serious issue that can have long-lasting effects on your financial health and peace of mind. By understanding the methods used by identity thieves and taking proactive steps to protect your personal information, you can reduce the risk of falling victim to this pervasive crime. Stay vigilant, stay informed, and take control of your identity to safeguard your future.

Stay safe and take action today to protect yourself from identity theft. Your identity is invaluable—treat it with the care it deserves.