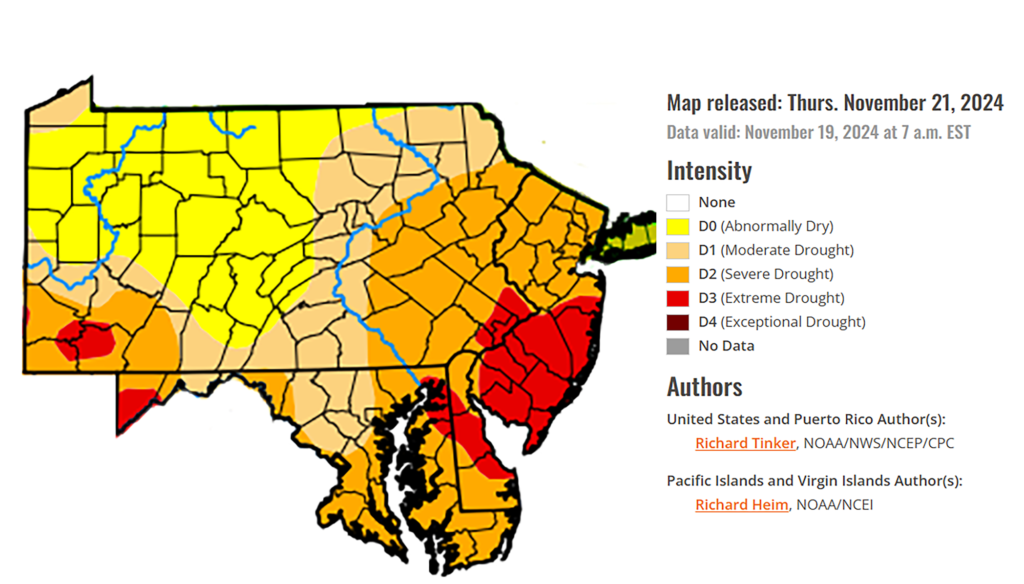

As meteorologists warn that an intense Arctic blast is set to sweep across the Mid‑Atlantic, homeowners and businesses are bracing for the kind of deep freeze that can turn a minor issue into a major claim overnight. At Curley Adjustment Bureau, preparation isn’t a scramble — it’s a year‑round discipline. When extreme weather hits, our team is already in motion.

Proactive Readiness, Not Reactive Response

Cold snaps bring a predictable surge in property claims: frozen pipes, ice damming, roof collapses, sprinkler system failures, and widespread water damage. Because these events unfold quickly, the difference between a smooth claims experience and a chaotic one often comes down to how prepared your adjusting partner is before the first temperature drop.

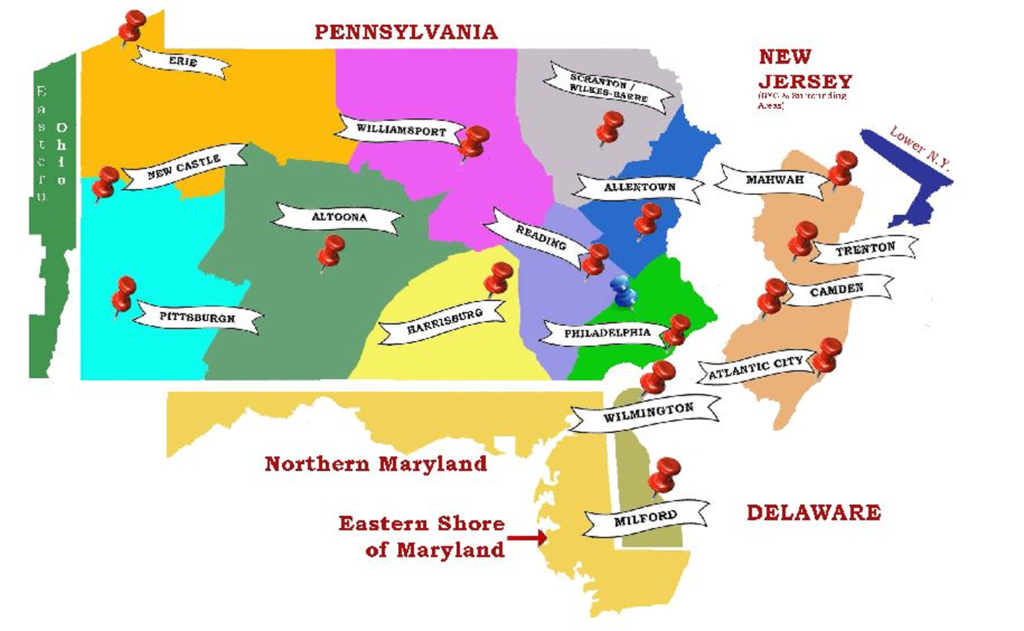

Curley Adjustment Bureau has spent the past several weeks reviewing staffing, tightening communication workflows, and coordinating with carriers to ensure we’re aligned on expectations and ready for volume. Our adjusters covering the DC and Baltimore regions — areas expected to feel the brunt of the cold — are already positioned for rapid deployment.

Experienced Adjusters, Local Knowledge

With more than two decades of property claims experience across the Mid‑Atlantic, our team understands the unique vulnerabilities of the region’s housing stock and commercial infrastructure. From historic rowhomes to modern office parks, we’ve seen how extreme cold affects different building systems — and we know how to document, evaluate, and move claims forward efficiently.

Our adjusters are fully equipped with:

- Xactimate proficiency for fast, accurate estimating

- Cold‑weather field gear to safely inspect properties even in harsh conditions

- Streamlined reporting tools to keep carriers updated in real time

- A deep bench of adjusters ready to scale as claim volume increases

Rapid Response Is Our Standard

When temperatures plunge, delays can worsen damage. That’s why we prioritize:

- Same‑day contact with insureds

- Timely on‑site inspections when conditions allow

- Clear, empathetic communication during stressful events

- Accurate, defensible estimates that help move claims toward resolution

Our goal is simple: minimize disruption for policyholders while delivering the high‑quality adjusting work our carrier partners rely on.

Supporting Carriers Through the Storm

Extreme weather events test the resilience of the entire claims ecosystem. Curley Adjustment Bureau is committed to being the steady, reliable partner carriers need during high‑volume periods. Whether it’s a single loss or a surge of claims across multiple counties, we’re prepared to step in with professionalism, speed, and clarity.

The Arctic Blast Is Coming — We’re Ready

As the region prepares for dangerous cold, Curley Adjustment Bureau stands ready to support our partners and the communities we serve. Weather may be unpredictable, but our commitment to excellence never wavers.

If you’d like a version of this tailored for LinkedIn, your website, or a more formal press‑release tone, I can shape it however you need.

Curley Adjustment Bureau wishes to announce its 85th Anniversary as a leading Independent Insurance Adjusting firm and Third Party Administrator.

Curley Adjustment Bureau wishes to announce its 85th Anniversary as a leading Independent Insurance Adjusting firm and Third Party Administrator. generations and eighty-five years later, Curley Adjustment Bureau still relies on this very same mission statement to foster continued growth and success for itself and its insurance and other business partners, within the ever-changing insurance industry.

generations and eighty-five years later, Curley Adjustment Bureau still relies on this very same mission statement to foster continued growth and success for itself and its insurance and other business partners, within the ever-changing insurance industry.